Tax bill opposed by majority heads to White House

Washington – The House of Representatives passed a bill that gives significant tax relief to the wealthy and corporations and some temporary relief to the middle class and those in poverty. A majority of Americans opposes the bill. It now heads to the White House for President Donald Trump’s signature.

Democrats call the legislation a boon to the rich that leaves middle-class and working Americans behind.

The vote was 224-201 and came hours after the Senate's early morning passage along party lines.

It is the first major overhaul of the nation's tax laws since 1986.

Related:

Lawmakers bicker over whether tax bill helps middle class

Paul Ryan does not care about the public opposition to the GOP tax bill

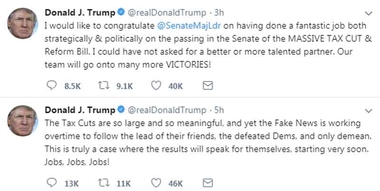

On Twitter and in White House remarks, Trump hailed the outcome, his own efforts and the work of GOP allies, including Majority Leader Mitch McConnell of Kentucky, who had drawn the president's wrath for the Senate's inability this past summer to dismantle the health care law.

"Our team will go onto many more VICTORIES!" Trump tweeted.

Congressional Republicans have cast the bill as a blessing for the middle class, an argument they will stress in their drive to hold onto their congressional majorities in next year's midterm elections.

Starting next year, families making between $50,000 and $75,000 will get average tax cuts of $890, according to an analysis by the nonpartisan Tax Policy Center. Families making between $100,000 and $200,000 would get average tax cuts of $2,260, while families making more than $1 million would get average tax cuts of nearly $70,000, according to the analysis.

But if Congress allows the cuts for individuals to expire, most Americans — those making less than $75,000 — would see tax increases in 2027, according to congressional estimates.

Estimates say the bill will add nearly $1.5 trillion to federal debt over the next decade.

Experts say the tax cuts are unnecessary. Matt Egan, writing on CNN.com said, “By splurging on a $1.5 trillion package of tax cuts, Congress will probably have less ammo to fight the next downturn. That's because the government needs to borrow more money to pay for the cuts.

"This tax cut makes us less equipped to deal with the next disaster, war or recession," Maya MacGuineas, president of the nonpartisan Committee for a Responsible Federal Budget, wrote in a statement on Wednesday.

Calling it the "wrong legislation at the wrong time," MacGuineas warned the tax plan will provide just a fleeting bump to economic growth at the expense of making the already daunting fiscal situation even worse.”

Ryan said Wednesday the GOP is willing to risk running up deficits with the aim of getting a higher annual economic growth rate.

The GOP has repeatedly argued the bill will spur economic growth as corporations, flush with cash, increase wages and hire more workers. But many voters in surveys see the legislation as a boost to the wealthy, such as Trump and his family, and a minor gain at best for the middle class.

Tax cuts for corporations would be permanent while the cuts for individuals would expire in 2026 to comply with Senate budget rules. The tax cuts would take effect in January, and workers would start to see changes for taxes withheld from their paychecks in February.

The bill lowers the top tax rate for well-off individuals from 39.6 percent to 37 percent.

The legislation repeals an important part of the 2010 health care law — the requirement that all Americans carry health insurance or face a penalty — as the GOP looks to unravel the law it failed to repeal and replace this past summer. A rise in insurance premiums higher in the next several years could come as younger, healthier people choose not to have health insurance.

Estimates of the number of people who would lose insurance coverage because the cost drives them out of the market range up to 13 million over the next decade.

Copyright The Gayly – December 20, 2017 @ 2 p.m. CST.