Who is in your wallet?

by Oklahoma State Rep. David Perryman

With a $1 billion state budget gap in the forecast, it would seem that everyone at the Capitol would be focused on avoiding more cuts to mental health funding, roads and bridges, higher education and career tech centers. One would think that finding some relief for Oklahoma's woefully underpaid public school teachers would be a high priority.

Unfortunately, the task of getting us out of this mire is in the hands of those who created the mess. Even more unfortunate is that they are using the same failed roadmap to get us to their version of "prosperity."

For instance, earlier this year, the Oklahoma Council of Public Affairs (OCPA) published an article in its Perspective magazine that exclaimed, "Why the Long Faces?" as the consensus of its "brain trust" illustrated that Oklahoma's budget shortfall presents a "valuable opportunity" to "right-size" (i.e. cut) government (and the services that it provides). OCPA's suggestions ranged from turning government services over to private corporations to downsizing and "phasing out the income tax" and replacing it with...nothing.

The article held up Kansas as a model of fiscal virtue that had recently made deep cuts to its state income tax rates, and argued that Oklahoma would do well to emulate. However, the 2015 edition of the Tax Foundation's "Facts and Figures" shows that Oklahoma's state and local tax burden was nearly 10% lower than Kansas' and Kansans paid 24.4% more in state and local taxes, 41% more in gasoline taxes and 126% more in property taxes than Oklahomans do.

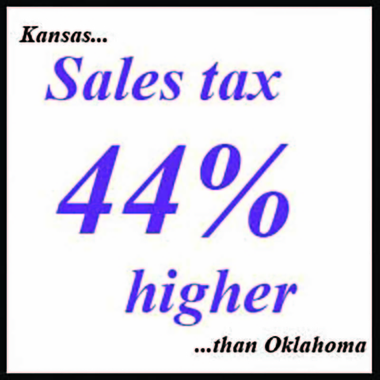

It is notable that since the date of the OCPA article, Kansas, feeling the negative impact of its income tax cuts, has found it necessary to increase its state sales tax to a rate that is 44% higher than Oklahoma's.

Now, the American Federation for Children (AFC) has issued a press release claiming that 7 out of every 10 Oklahomans want to take public tax dollars and transfer them to private or religious schools.

BEWARE: Even in these dire financial straits, the OCPA, the AFC, the American Legislative Exchange Council and other school voucher proponents (collectively, the "Takers") are triangulating to get in your wallet again.

Past Taker accomplishments are tax credits, tax deductions and tax-free "scholarships" that already divert tax dollars from the General Fund to private and religious schools. During the last legislative session, Takers successfully sponsored a bill allowing the Department of Education to approve charter schools anywhere in the state, even when the local school board objects.

Now, through a series of misleading and ambiguous poll questions, these perennial Takers are laying the groundwork to justify the introduction of legislation shifting millions of dollars from public education to private schools through the use of vouchers and tax-funded "educational savings accounts." Faulty as the poll is, the state's anti-public education newspaper is now promoting it. Surprise, Surprise. Who's in your wallet?

Dec. 11 is the last day to request legislation and I welcome your comments at 1-800-522-8502 or at David.Perryman@okhouse.gov

The Gayly - 12/1/2015 @ 11:02 a.m. CST